stock average cost formula

The formula for calculating the dollar cost average over 3 purchase periods looks like this. Price Average Price Of New Stocks Bought 2.

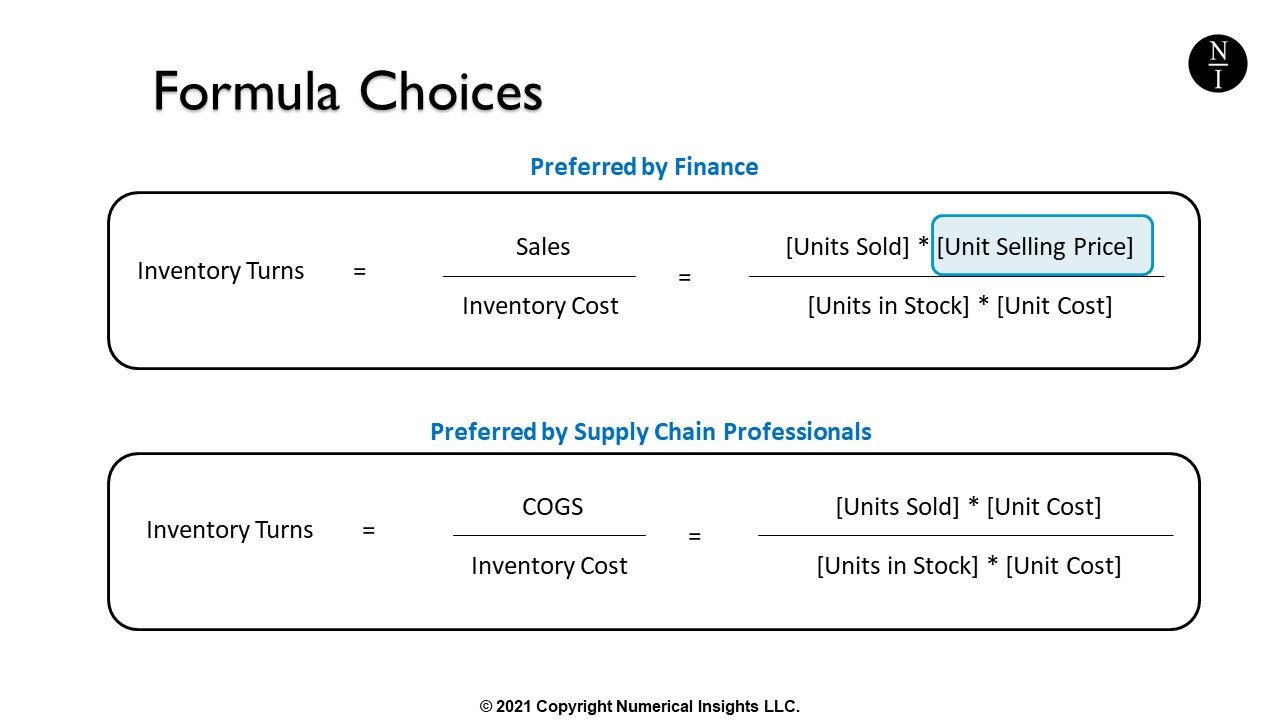

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share.

. 1500 5 500 75 500 9 500. You then buy another 100 shares at 30 per share which lowers your average price to 45 per share. Costs of goods available for sale is calculated as beginning inventory value purchases.

Purchase Value- 100 x 3 300. Total cost of all three stock purchases 1825. Total cost of production at 1500 units Total fixed cost Total variable cost.

This is because that fixed cost is now spread over 2000 units and per unit fixed cost. Average Total Cost 1973. P Stock Price.

How To Calculate DCA. So Tony bought another 200 ADA at a. This leaves 440 units in stock with a value of 880 since each unit is worth 2.

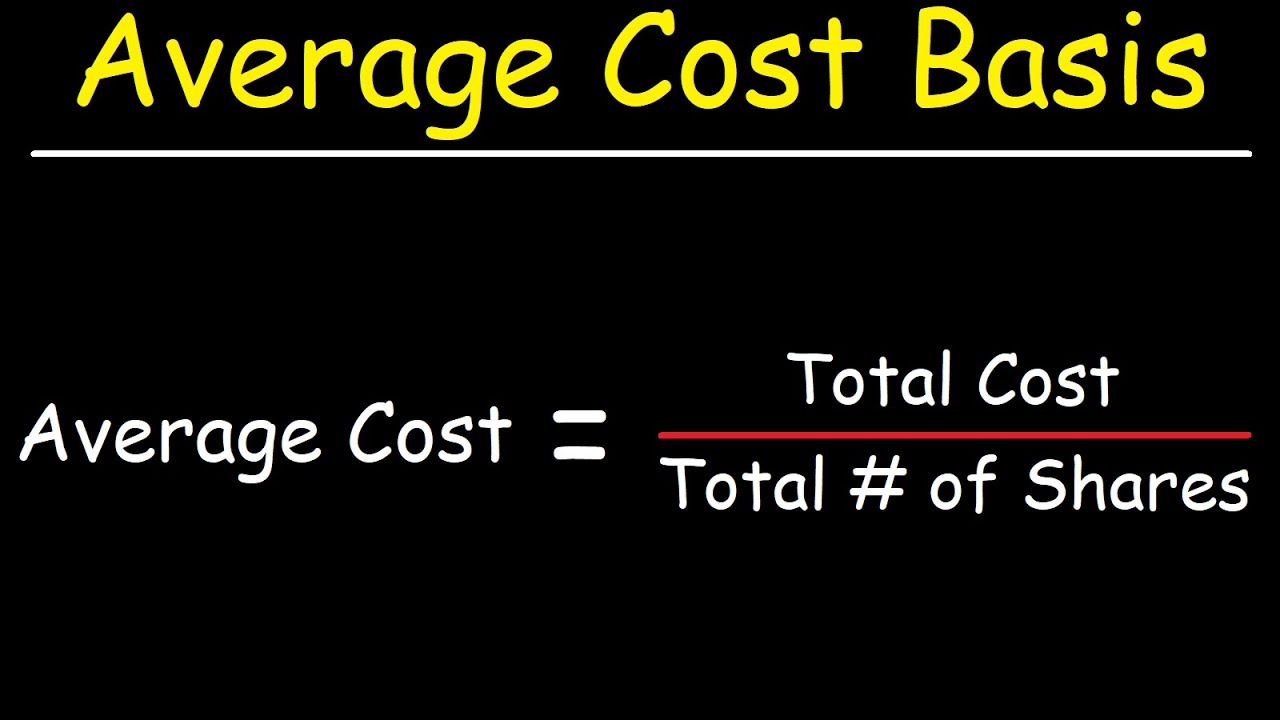

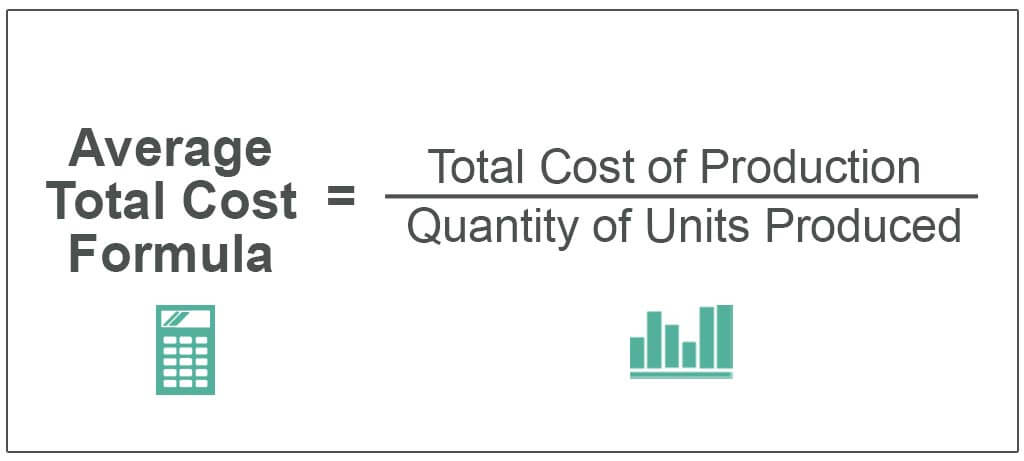

Average cost total cost at various times divided by the total quantity. Average Total Cost 3945000 2000. Take your previous.

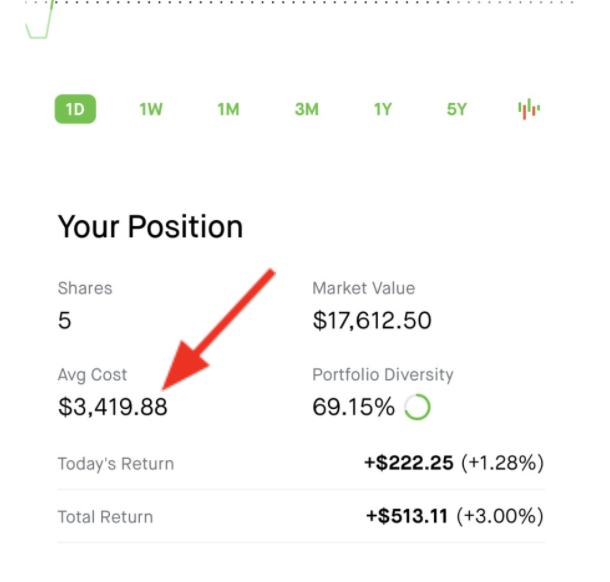

Take the original investment amount 10000 and divide it by the new number of shares you hold 2000 shares to arrive at the new per-share cost basis 100002000 5. Weighted Average Cost WAC Method Formula. So Id state XXX Average Cost of holding is 13350665 and for ZZZ is 2200400 being the latest date for a stock with a positive purchase qty.

Tips for Calculating the Cost of Inventory Formula. Divide the total amount invested by the total shares bought. E Market value of the firms equity D Market value of the firms debt V E.

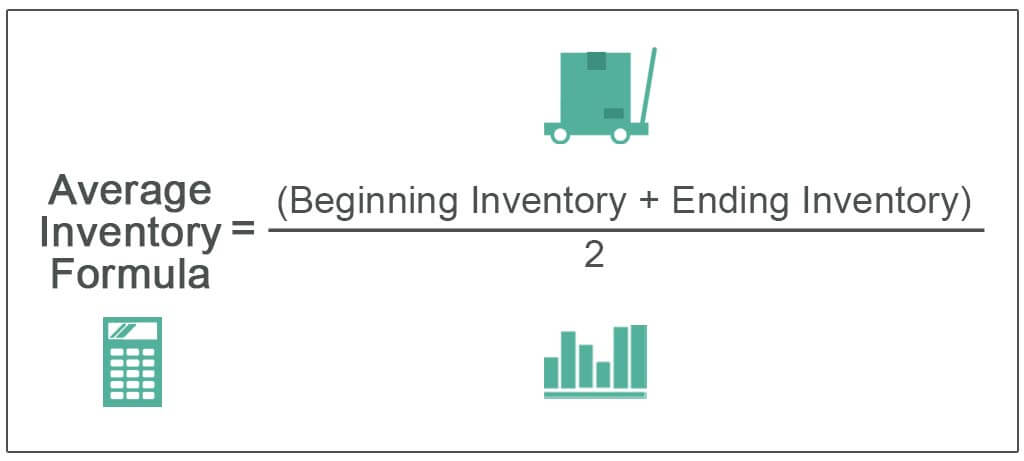

This simple equation allows you to find out how much inventory a company has on hand averaged across its entire inventory. The formula for average stock is. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

An investor can benefit from the FIFO method only when the initial tranche of shares are purchased at a lower price. For example if you buy 100 shares at 20 and later buy another 100 shares at 30 your total cost basis is 5000 100 20 100 30. Average cost total costtotal coins acquired.

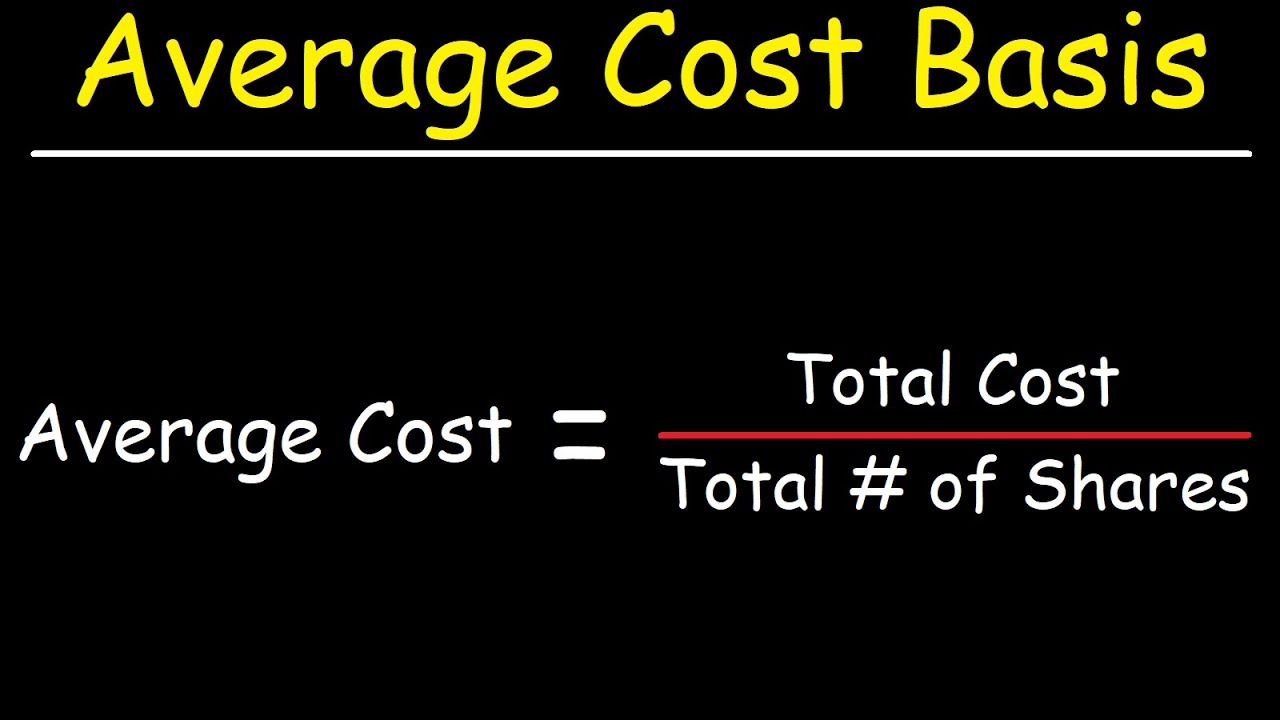

I think youre saying my average costs for the current holding of 50 XXX and 200 ZZZ is 133 and 2 respectively. Average cost total costnumber of shares. Then you bought another 25 shares at 15.

Last week Tony bought a cryptocurrency coin called ADA Cardano he bought 100 ADA with an average buy of 2 so the total cost is 200. The average inventory value was 4000 3900 800 3 2900. The average adjusted cost basis per share is 25 5000 200 shares.

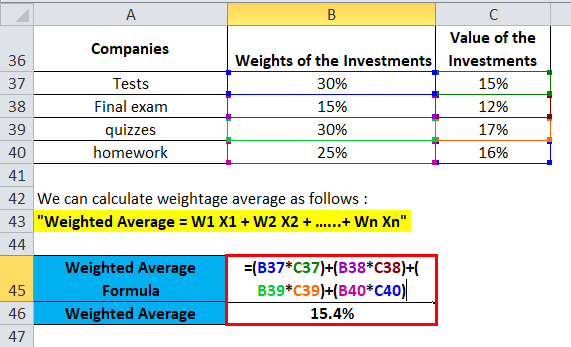

Although as you enter subsequent transactions it can become harder to follow. To get unit cost take the total amount of 2520 and divide by the 220 total units available to get the weighted average unit cost of 1145. For stocks the formula we use for the average cost calculator spreadsheet is as follows.

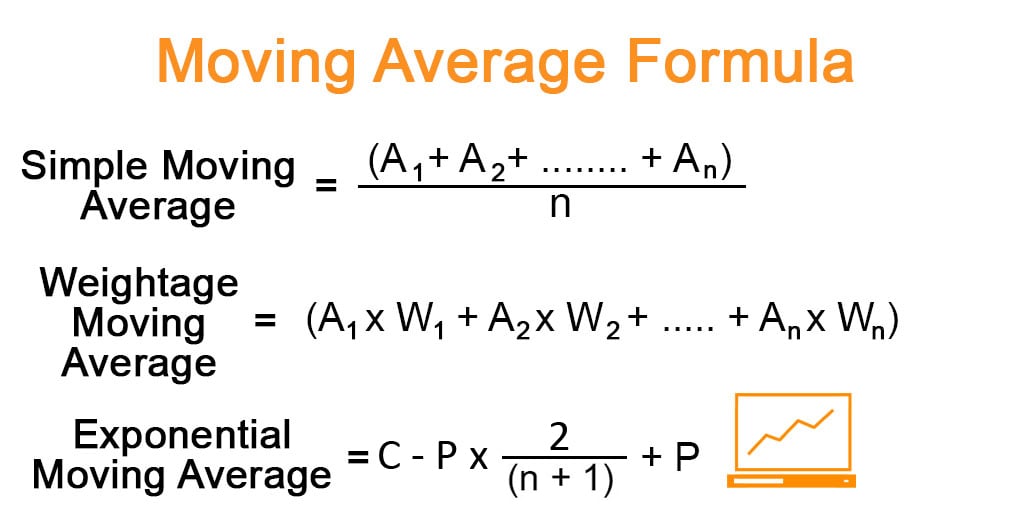

Dollar-Cost Average P T P T P T T. Average stock opening stock closing stock 2. Dollar-Cost Average Total Amount Invested Total Number of Shares Owned.

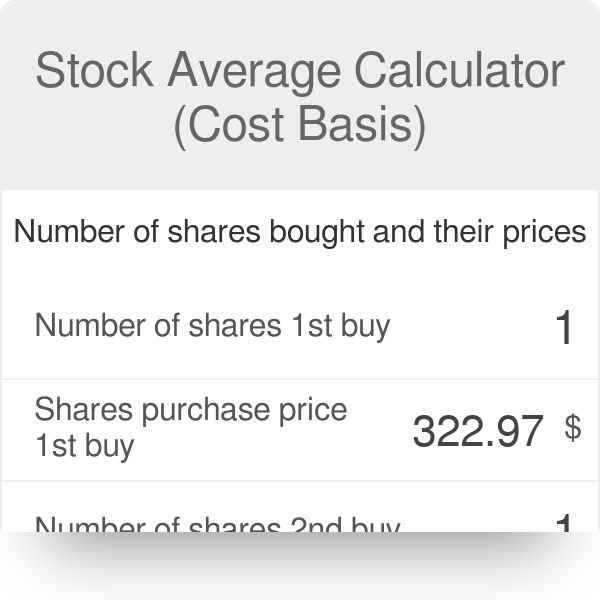

The formula behind this is simple. Here comes this tool Share Average Calculator Stock Average Calculator by FinanceX. After a month the cryptocurrency that he bought dropped to 1.

To calculate the weighted average of all inventory at this point they add the balance-amount of 600 to the receipt-amount of 1920 for a total of 2520. At 1500 units 12250 1500. An even simpler formula for calculating the Dollar Cost Average.

Average Cost per share Total purchases 2750 total number of shares owned 5661 4858. Lets Now Calculate The Average Price In A Stock Portfolio Now to give you a basic mathematical equation on how COL Financial computes for the average price see the formula below. Here is how to calculate the average purchase price for any stock position.

This makes the new inventory value 1100 and the latest moving average cost 204. The formula for the weighted average cost method is as follows. To compute the average price divide the total purchase amount by the number of shares purchased to get the average price per share.

Later that month they purchase 100 additional units at 3. This means that over those three months your business had an average of 766 items in stock at a total inventory value of 2900. First youd need the total cost of each purchase.

And lastly you bought 50 shares at 9. T Number of Shares Purchased. So lets say you bought 100 shares at 10.

Dividing the sum of total cost by the number of the total shares. New Average Price Previous Ave. 100 x 10 1000 25 x 15 375 50 x 9 450.

How to use average inventory calculations. So if you see here as we increase the number of cars the average total cost per car dropped. For cryptocurrencies the calculation is essentially the same but the terminology is different.

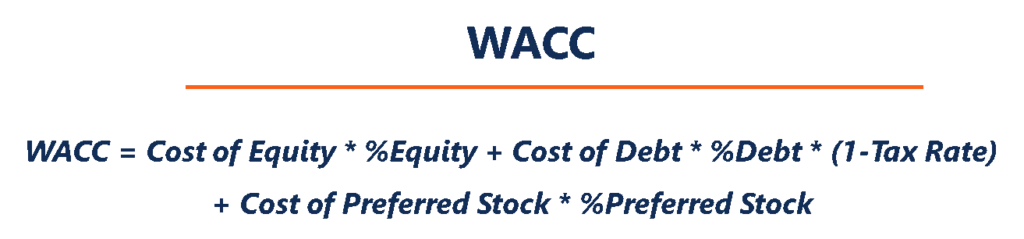

This is part of a video series and dives deep i. What is the formula for average stock. WACC E V R e D V R d 1 T c where.

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. Averaging into a position can drive to a much different breakeven point from the initial buy. Based on your inputs It will tell you the average price.

Time to achieve Excellence in ExcelIn this video you will learn how to calculate the average price in Excel. You can use this information to create an average inventory target. You want to reduce the average stock price by buying more stocks but you need to calculate how many stocks you need to buy to make the average closer to the current price.

You can also figure out the average purchase price for each investment by dividing the amount invested by the shares bought at each. 50 2 100. Units available for sale are the number of units a company can sell or the total number of units in inventory and is calculated as beginning inventory in units.

As illustrated above we can clearly see that the average cost method is the least punitive method of calculating the cost basis. In this case it can be seen that the average total cost initially decreases with the increase in the production quantity till 1000 units. Inventory Value- 440 x 2 880.

Stock Average Calculator Cost Basis

Moving Average Formula Calculator Examples With Excel Template

Average Total Cost Formula Step By Step Calculation

Dollar Cost Averaging Dca Investing Strategy In Stock Market

How To Calculate Weighted Average Price Per Share The Motley Fool

Wacc Formula Definition And Uses Guide To Cost Of Capital

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

How To Calculate Weighted Average Price Per Share Fox Business

Weighted Average Formula Calculator Excel Template

Formula To Calculate Inventory Turns Inventory Turnover Rate

Average Formula How To Calculate Average Calculator Excel Template

How To Calculate Weighted Average Price Per Share The Motley Fool

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)